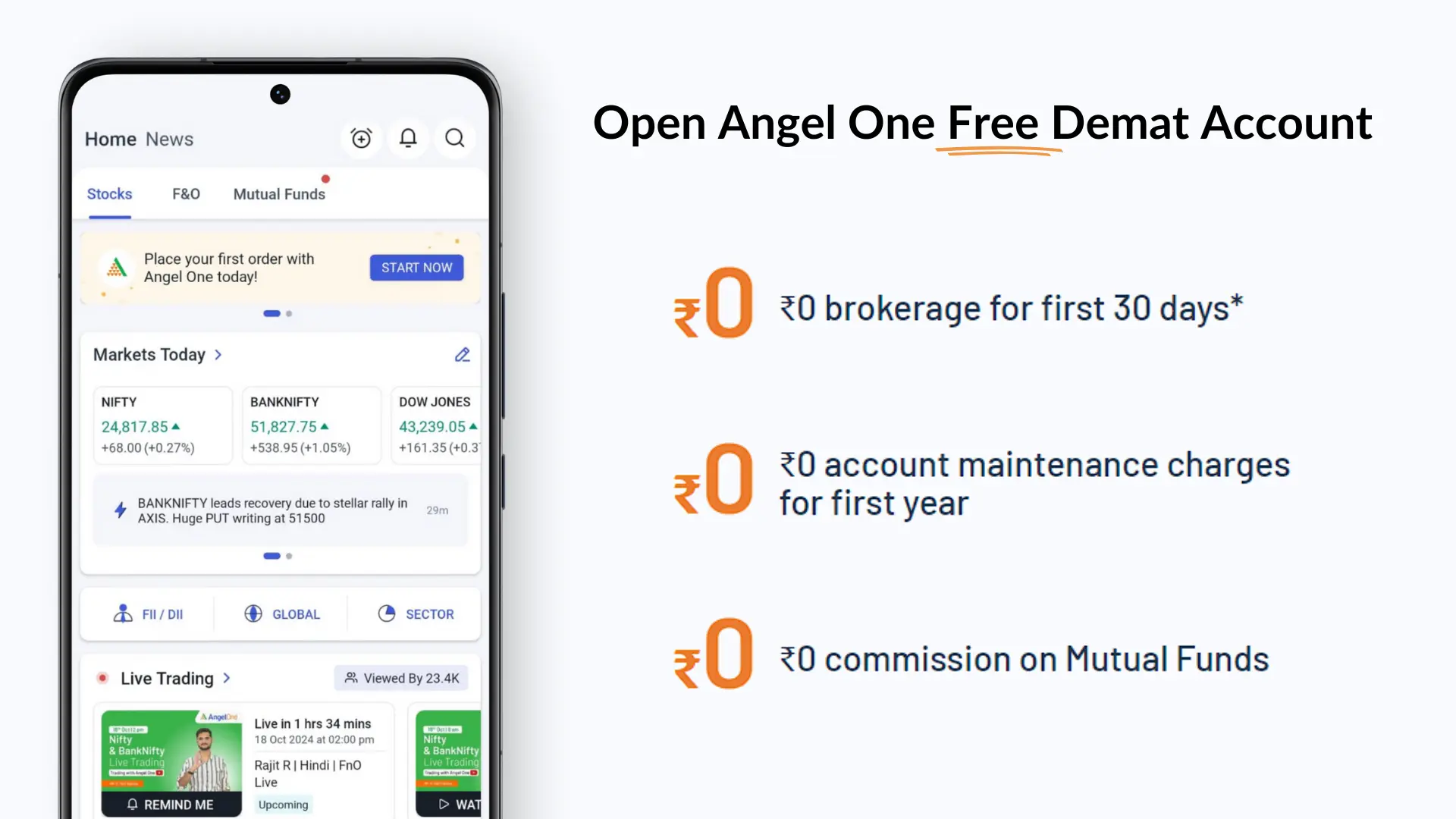

Angel One Free Demat Account

Open Free Demat Account with Angel One

A demat account is a must-have for anyone looking to invest in the stock market, serving as a digital vault for holding securities like stocks, mutual funds, and bonds. Among the many options available, Angel One stands out as a leading choice for opening a free demat account.

Angel One, a prominent Indian retail brokerage firm, has been catering to investors for over three decades. Established in 1987 as Angel Broking, the company rebranded to Angel One in 2019 to align with its digital-first approach and expanded product offerings. The company’s platform offers seamless access to financial services, including stock broking, currency and commodity trading, margin trading, mutual funds, and portfolio management.

With a focus on digital innovation, Angel One has built a robust platform accessible through its mobile app, web-based trading platform, and API integrations. This not only enhances the convenience of managing investments but also reduces costs, making it a smart choice for investors.

Open Free Demat Account with Angel One

Why Angel One Free Demat Account?

Angel One offers several compelling reasons to open a free demat account with them. First, they are a trusted name, having provided services to crores of customers since 1987. The platform provides a quick onboarding process, with fully digitized onboarding, allowing users to easily provide personal details, bank details, and complete eKYC seamlessly.

Another major advantage of Angel One is its simplified trading system. Whether you prefer Android, iOS apps, or desktop platforms, the user-friendly interface makes it convenient for both novice and seasoned traders. Furthermore, Angel One offers competent brokerage services, with Rs 0 brokerage on equity delivery and a flat Rs 20 on intraday, F&O, currencies, and commodities.

Additionally, Angel One offers a rule-based investment advisory engine, ARQ Prime, which assists clients in making informed decisions, providing personalized recommendations based on their investment goals.

These features—trust, quick onboarding, simplified trading, advisory support, and competitive brokerage—make Angel One an excellent choice for anyone looking to start their investment journey.

Investment Options with Angel One Demat Account

Angel One offers a comprehensive range of investment options, making it an ideal platform for investors seeking diversification. Through their demat account, users can invest in:

- Stocks: Explore opportunities in the stock market with access to a variety of companies.

- IPO: Participate in Initial Public Offerings (IPOs) and invest in companies during their early stages of public trading.

- F&O (Futures & Options): Leverage futures and options trading to hedge or speculate in the market.

- Mutual Funds: Build a diversified portfolio by investing in professionally managed mutual funds.

- Commodities: Trade in key commodities such as gold, silver, crude oil, and more.

- US Stocks: Invest in global giants by trading in US stock markets, expanding your investment beyond Indian borders.

- Intraday Trading: Take advantage of daily price movements through intraday trading opportunities.

- Debt Market/Bonds: Invest in the debt market to balance your portfolio with low-risk, fixed-income assets.

- ETFs (Exchange-Traded Funds): Enjoy the benefits of diversified investment with low expense ratios by investing in ETFs.

This diverse selection of asset classes allows investors to tailor their portfolios to fit their financial goals and risk preferences, all within a single platform.

Open Free Demat Account with Angel One

Facilities Offered by a Demat Account

A demat account at Angel One offers investors a comprehensive and hassle-free way to manage their securities. Whether you are a seasoned trader or a new investor, the range of features provided makes it easy to handle various aspects of trading and investment. With Angel One account opening online, you can enjoy convenience, security, and advanced functionality. The Angel One open demat account process allows you to transfer shares, convert securities between physical and electronic forms, and access real-time updates on corporate actions. Additionally, with facilities like loan collateralization and the option to freeze your account, Angel One ensures that investors have full control over their assets. Whether you are looking for fast settlements, advanced research tools, or ease of trading, Angel One provides the necessary facilities to make your investment journey smooth and secure.

Seamless Transfer of Investments:

With an Angel One demat account, you can easily transfer your holdings, such as shares and other securities, by simply filling out a Delivery Instruction Slip (DIS). This ensures a smooth transfer of investments between accounts, offering convenience for managing multiple assets efficiently.

Dematerialisation and Rematerialisation:

Converting securities between physical and electronic forms is straightforward with an Angel One trading account. Investors can request the dematerialisation of physical share certificates into electronic form through their Depository Participant (DP). Similarly, if needed, you can opt for rematerialisation, which converts electronic holdings back into physical certificates by submitting a Remat Request Form (RRF).

Loan Facility:

Securities held in an Angel One free demat account can serve as collateral for loans. Angel One allows investors to easily access their holdings and present them as security when applying for loans from financial institutions, making it a convenient option for leveraging assets.

Corporate Actions Management:

An AngelOne demat account simplifies the process of tracking corporate actions such as stock splits, bonus issues, or other shareholder-related actions. These updates are automatically reflected in your account, ensuring accurate and real-time management of your portfolio.

Account Freezing Option:

Angel One free demat account provides the ability to freeze your demat account to prevent any unauthorized transactions. This is a valuable feature for securing your holdings during specific periods of inactivity or heightened market volatility.

Speed E-Facility:

With NSDL’s Speed E-facility, you can execute trades electronically when you open Angel One demat account without the need for paperwork. Transactions are completed efficiently by submitting an e-slip to your DP, making the trading process faster and more convenient.

These facilities offered by Angel One ensure that managing investments is not only efficient but also secure, giving investors greater flexibility and control over their portfolios.

Documents Required for Opening an Angel One Demat Account

Opening a demat account with Angel One has become an incredibly simple process thanks to advancements in online procedures. You no longer need to physically visit a broker’s office, and the entire account creation can be completed within an hour. However, it’s important to have all the necessary Angel One account opening documents ready for a smooth account opening. Here’s what you need:

Key Documents for Demat Account Opening:

- PAN Card: Essential for identity verification and mandatory under financial regulations.

- Aadhaar Card: Serves as proof of address and is vital for completing the KYC (Know Your Customer) process.

- Bank Details: A canceled cheque or a recent bank statement is required to link your bank account to the demat account for fund transfers.

- Signature: A proper photo of signature or scanned signature with dot pen on white paper.

Additional Documents You May Require:

- Identification Proof: In addition to the PAN and Aadhaar, other forms of ID like a Passport, Voter ID, Driving License, or even a College Identity Card may be accepted as part of the Angel One account opening documents.

- Address Proof: You can provide a utility bill (electricity, phone, water), a bank statement, land receipt, or ration card for address verification, which are all essential Angel One account opening documents.

Linking Your Trading and Demat Accounts

To trade, you need a trading account that is linked to your Angel One free demat account. While you can have separate brokers for these accounts, it adds complexity and transaction time. It is advisable to open both accounts with the same broker for seamless transactions and faster execution, ensuring a smoother trading experience.

Filing a Nomination

An often overlooked yet crucial step in Angel One account opening online is filing for a nominee. This will simplify the process of transferring your holdings in case of unforeseen events. We highly recommend adding a nominee during the account opening process itself to avoid complications later.

For investing , you need to have these three in place – a bank account, a trading account and a demat account.

Open Free Demat Account with Angel One

Step-by-Step Process to Open Angel One Free Demat Account Online

Opening a demat account with Angel One is a quick and convenient process, thanks to its fully digital platform. With just a few clicks, you can complete the Angel One demat account opening process from the comfort of your home. Whether you’re a first-time investor or an experienced trader, Angel One provides a seamless account opening experience with minimal paperwork and instant KYC verification. In the following guide, we’ll walk you through each step of the process, detailing how to open an Angel One account online with clear explanations and images to ensure clarity at every stage.

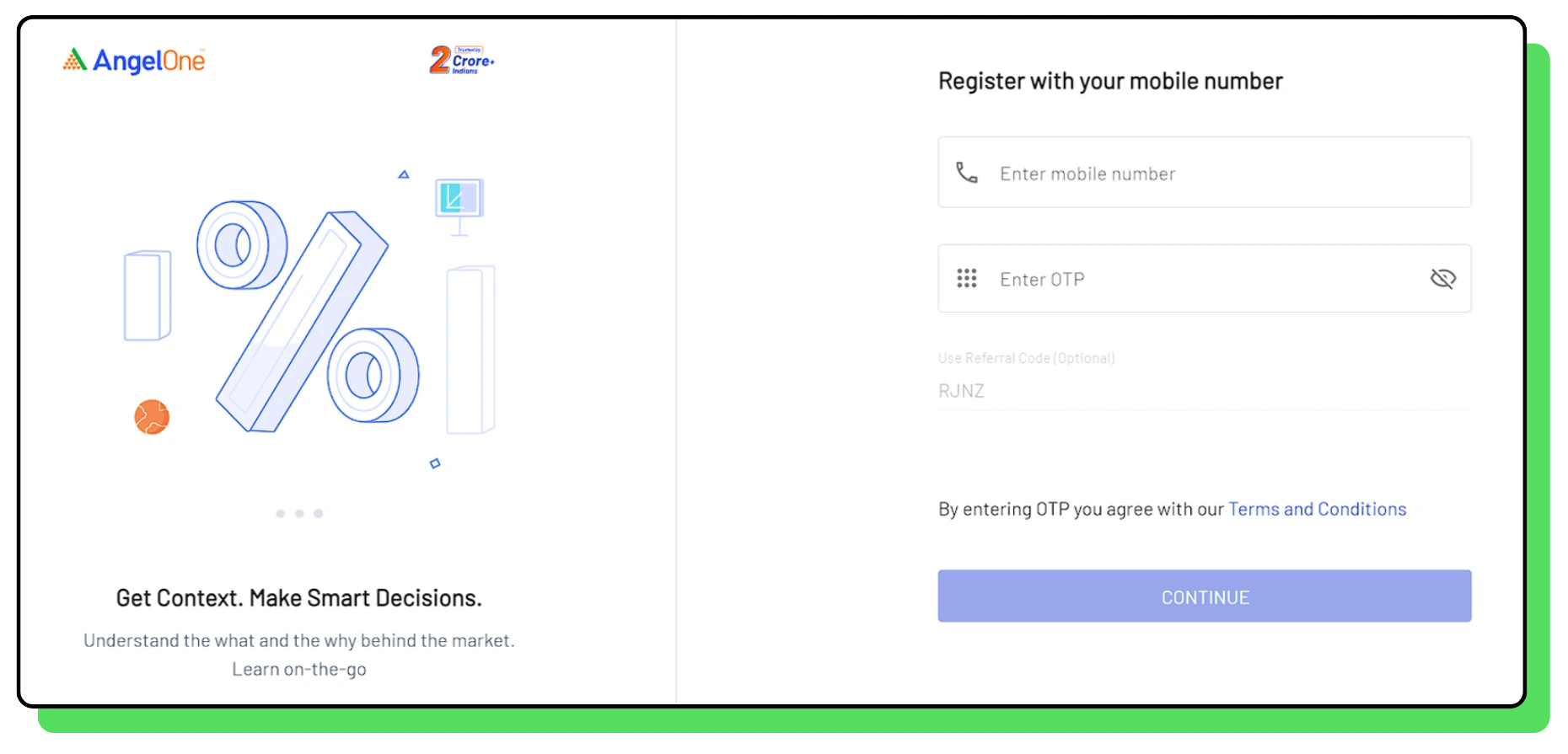

Step 1: Enter Your Mobile Number

Click Here to begin. Once the page opens, enter your mobile number in the provided field. After entering the number, you’ll receive an OTP on your phone. Fill in the OTP and click on the “Continue” button to move forward.

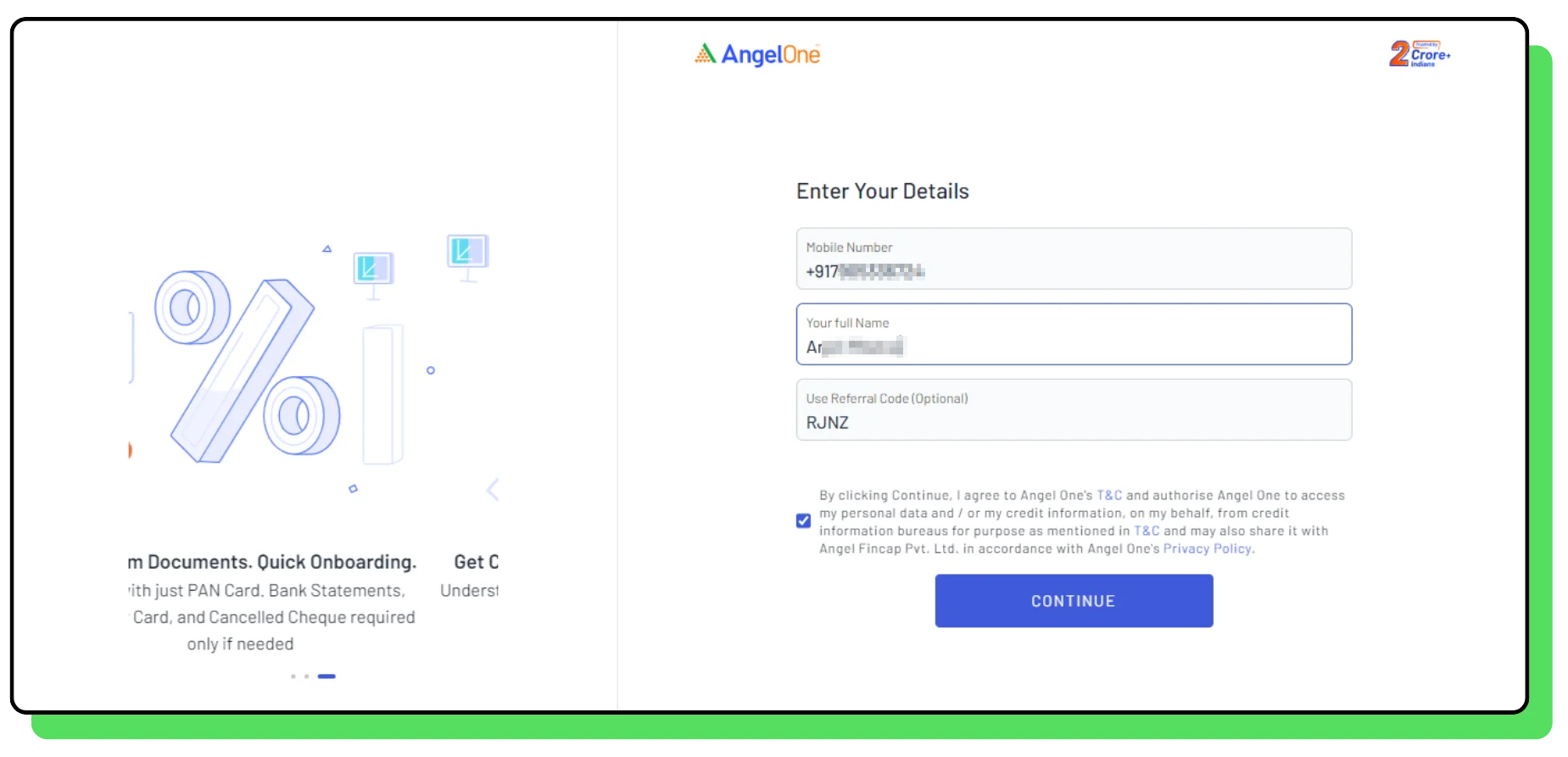

Step 2: Fill in Your Full Name and Referral Code

After verifying your OTP, the next step is to enter your full name. Ensure that the referral code RJNZ is already filled in the referral code column. By using this referral code, you’ll receive additional assistance in case of any issues during the account opening process, including support over a call.

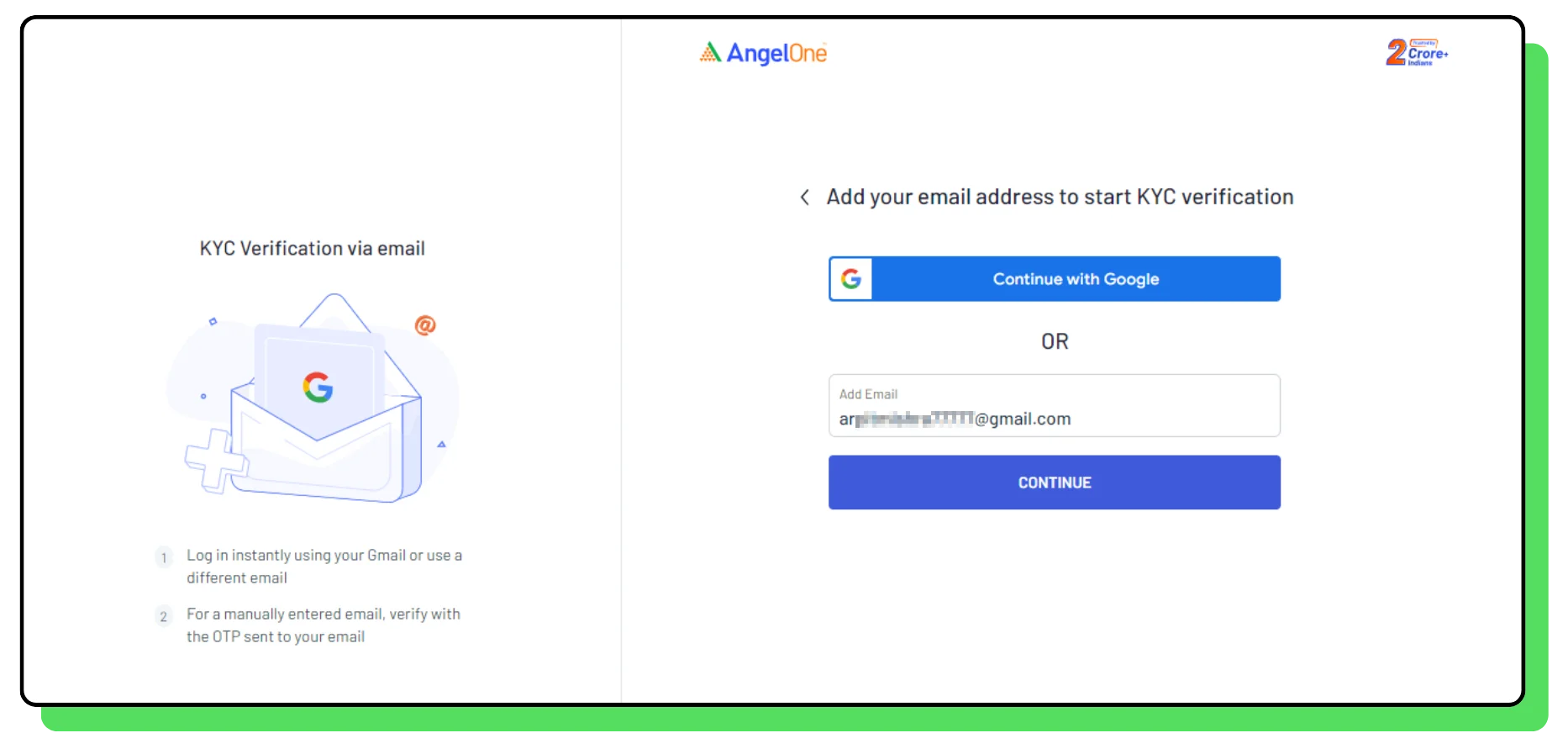

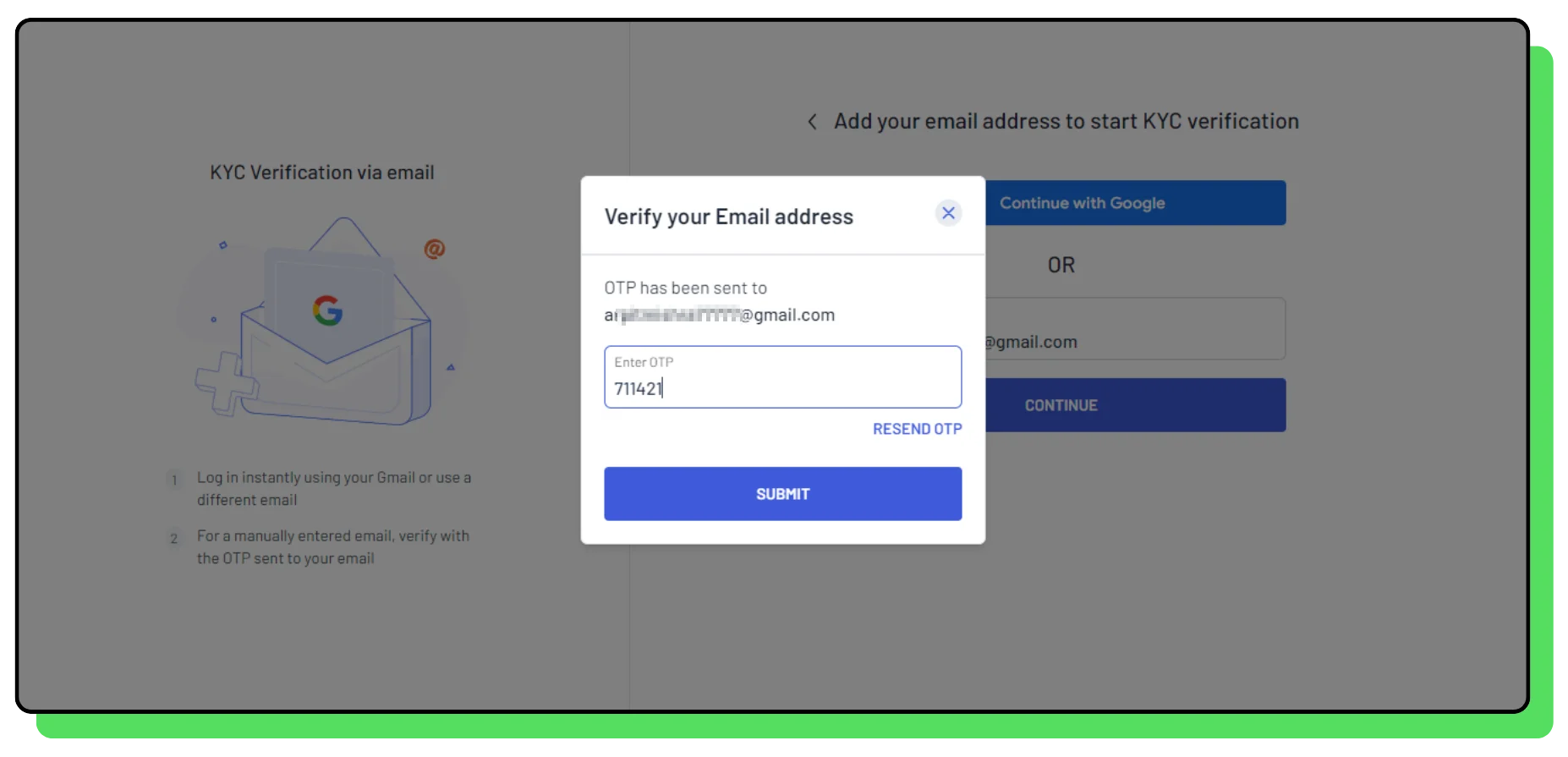

Step 3: Enter Your Email Address

Now, fill in your email address and click on the “Continue” button. You will receive an OTP in your email to verify the provided email address.

Step 4: Verify Your Email with OTP

Check your email inbox for the OTP. Once you have the OTP, enter it in the given field to complete the email verification process.

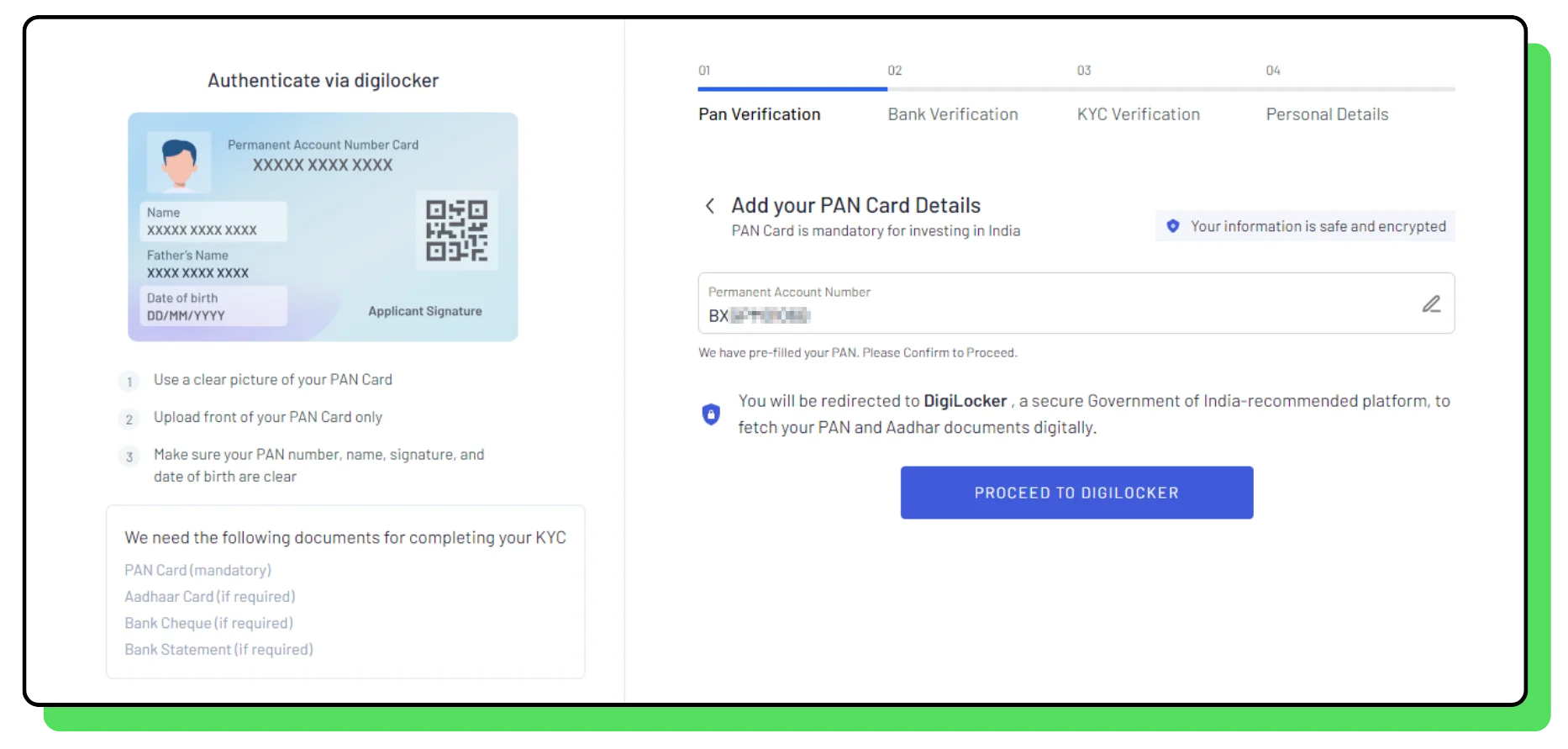

Step 5: Enter Your PAN Card Number

In this step, you will need to enter your PAN card number. In most cases, Angel One can automatically fetch your PAN card details through your registered mobile number. If not, you can manually enter the PAN number. Make sure to double-check the number for accuracy. After entering your PAN, click on the “Proceed to Digilocker” button, as Angel One will use Digilocker to verify your documents digitally.

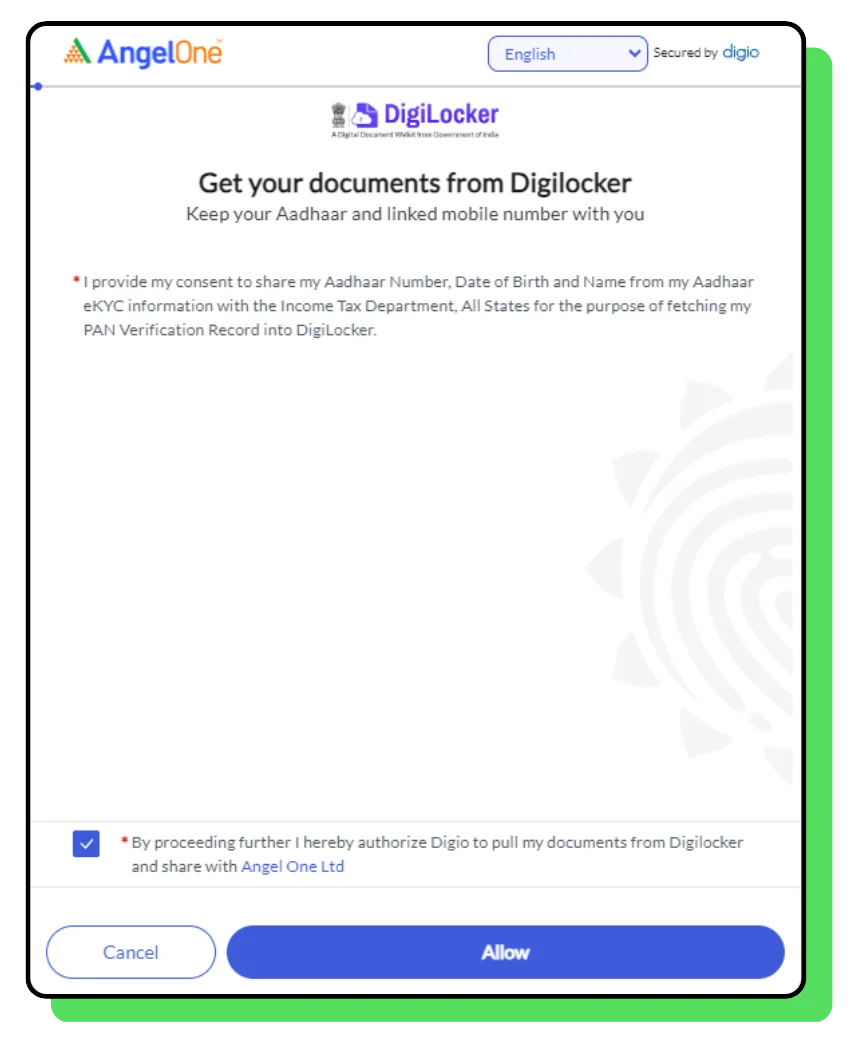

Step 6: Allow Digilocker Access

In this step, you are required to give Angel One permission to access your Digilocker account so that they can verify your documents digitally. Click on the “Allow” option to proceed.

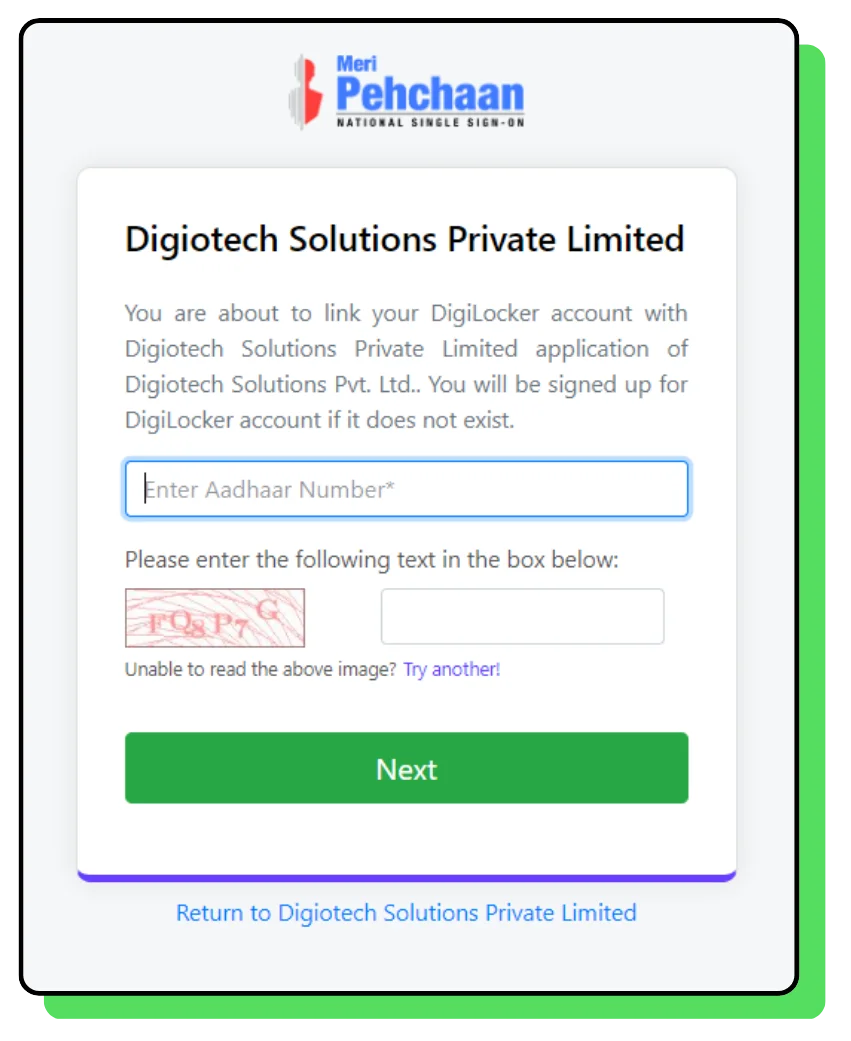

Step 7: Enter Your Aadhaar Card Number

In this step, you need to enter your Aadhaar card number along with the captcha code. Please ensure that the Aadhaar number you provide is linked with your mobile number because you will receive an OTP on your phone in the next step.

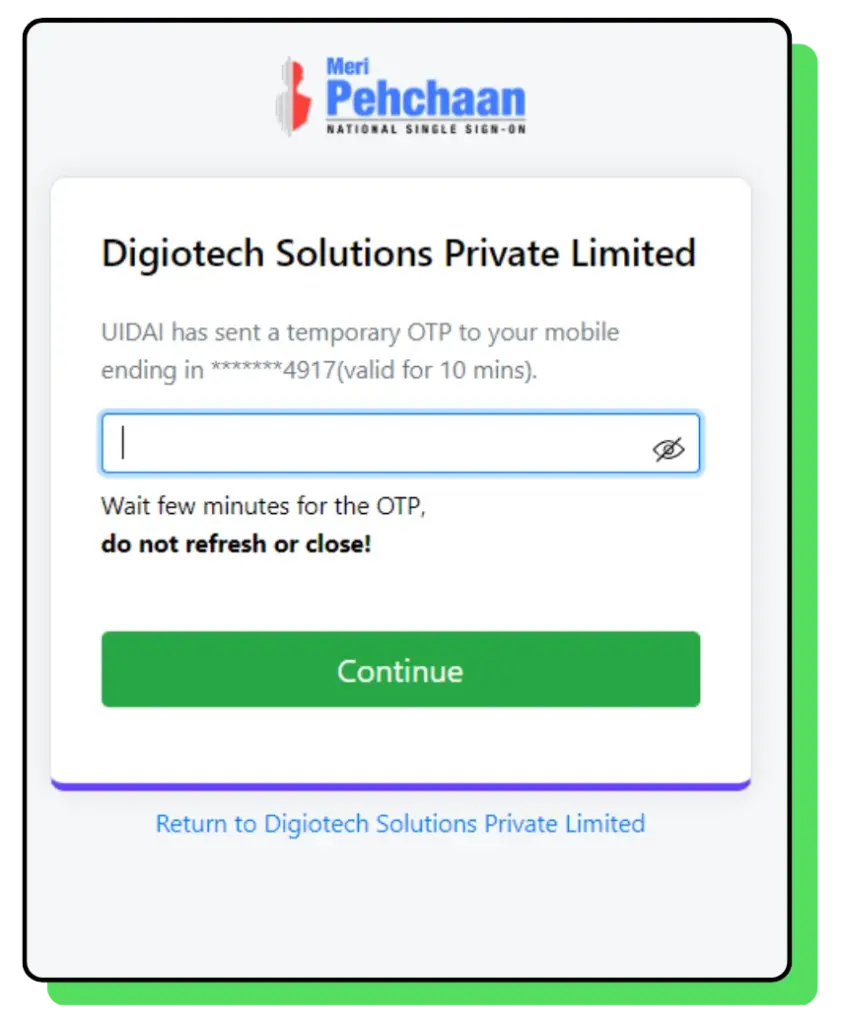

Step 8: Enter the OTP from Your Aadhaar-Linked Mobile Number

You will receive an OTP on the mobile number linked with your Aadhaar. Enter the OTP and click on the “Continue” option to proceed.

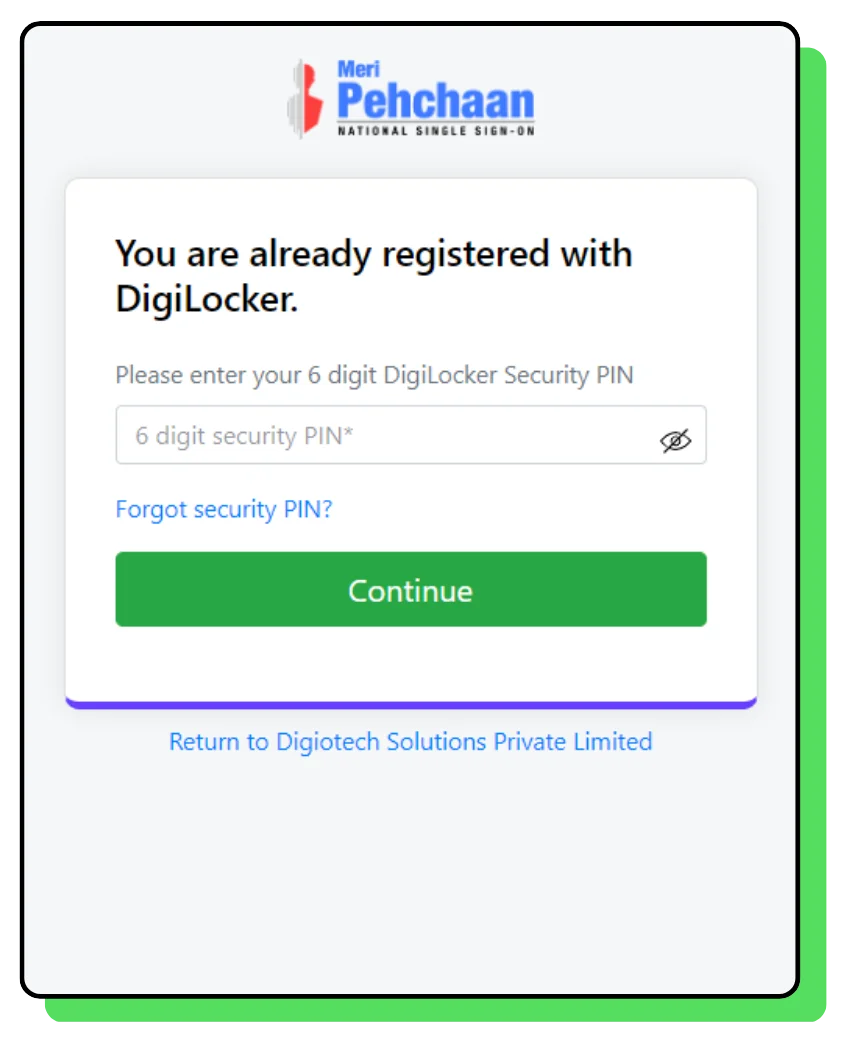

Step 9: Enter Your DigiLocker PIN

If you are already registered on DigiLocker, enter your 6-digit DigiLocker PIN. After entering the PIN, click on the “Continue” option to proceed.

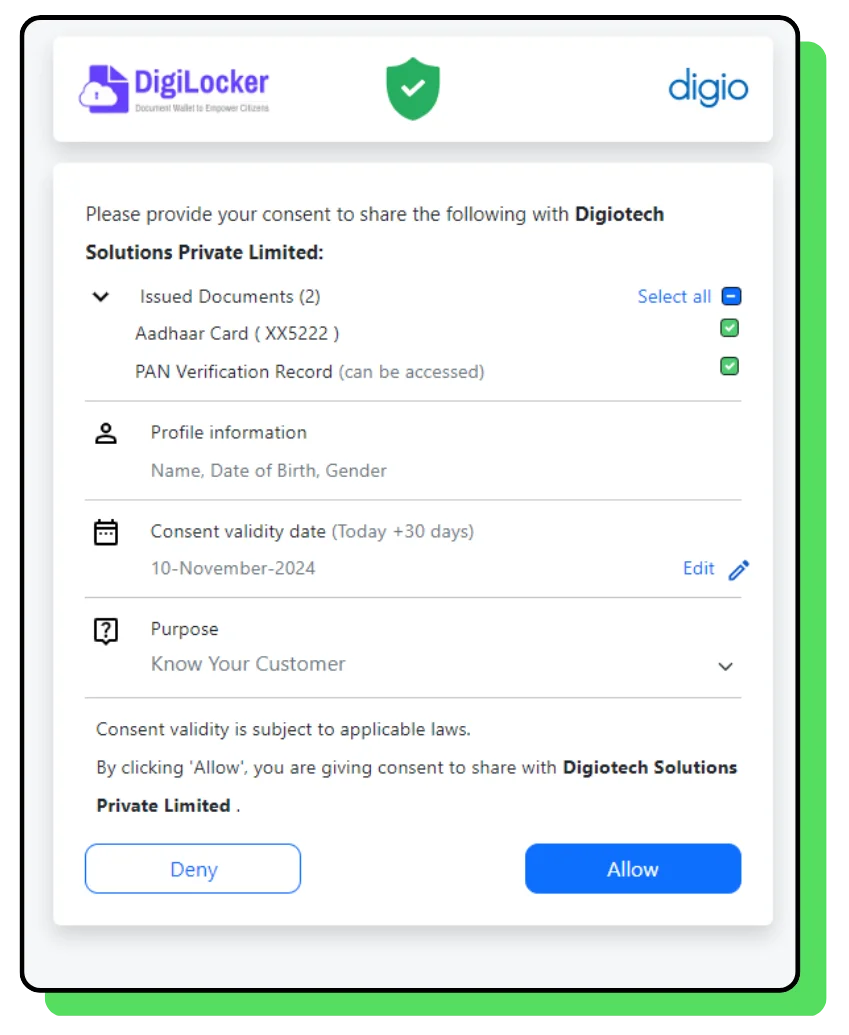

Step 10: Share Your Consent for Document Verification

In this step, you’ll need to provide your consent for the digital verification of your issued documents, specifically your Aadhar Card and PAN Card, from your DigiLocker. You’ll also share your Profile Information for KYC purposes. You can set your Consent Validity Date according to your preference; by default, it will be set to “30 days + today”. Click the “Allow” button to proceed to the next step.

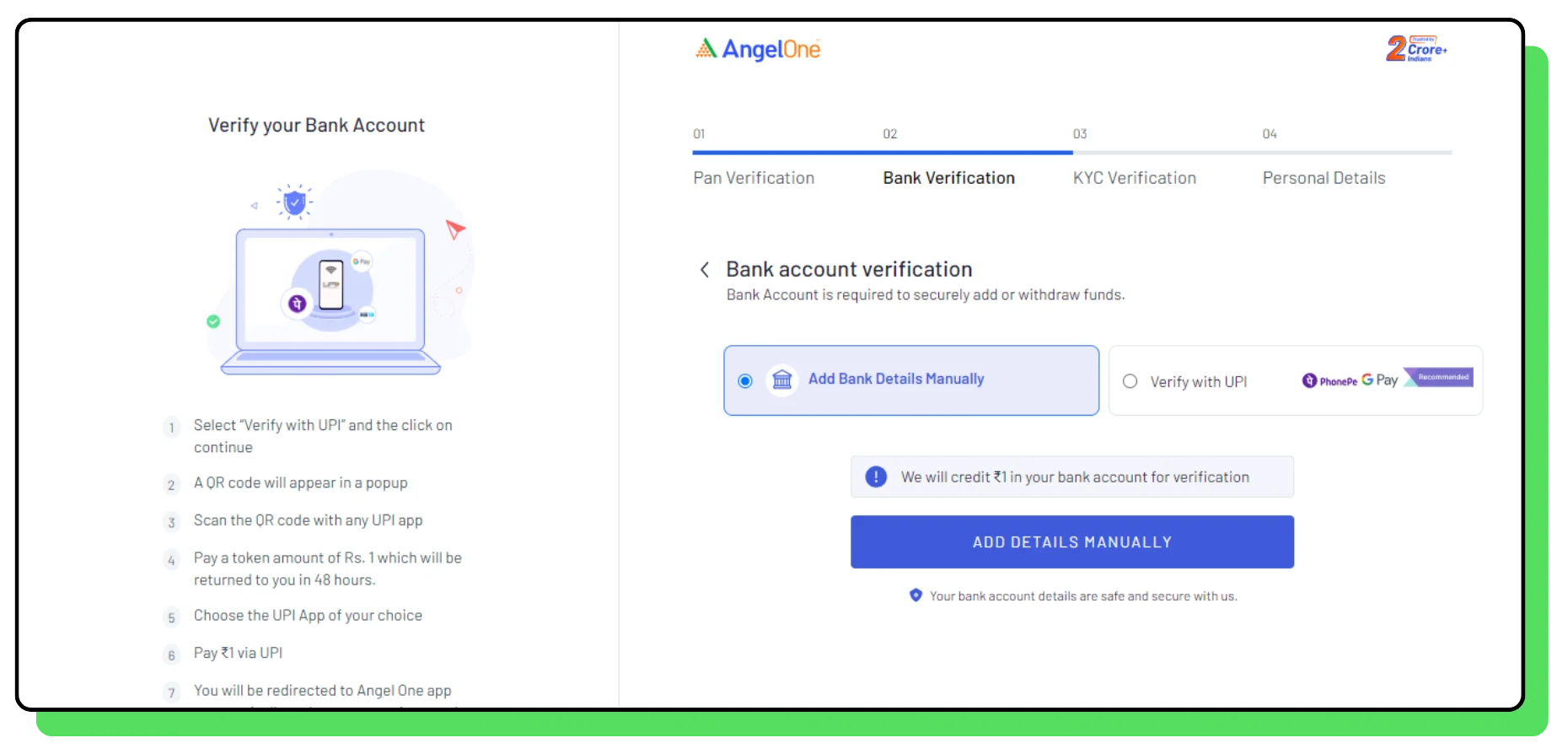

Step 11: Bank Account Verification

After completing your PAN and Aadhar verification, you will need to verify your bank account. You have two options for this: Add Bank Details Manually or Verify with UPI. It is recommended to select the “Verify with UPI” option. A nominal amount of ₹1 will be deducted from your account for verification, but don’t worry—this amount will be refunded within 48 hours. Please note that linking two bank accounts is not allowed, so ensure you link the active bank account you intend to use for future trading. Click on the “Verify with UPI” option to proceed to the next step.

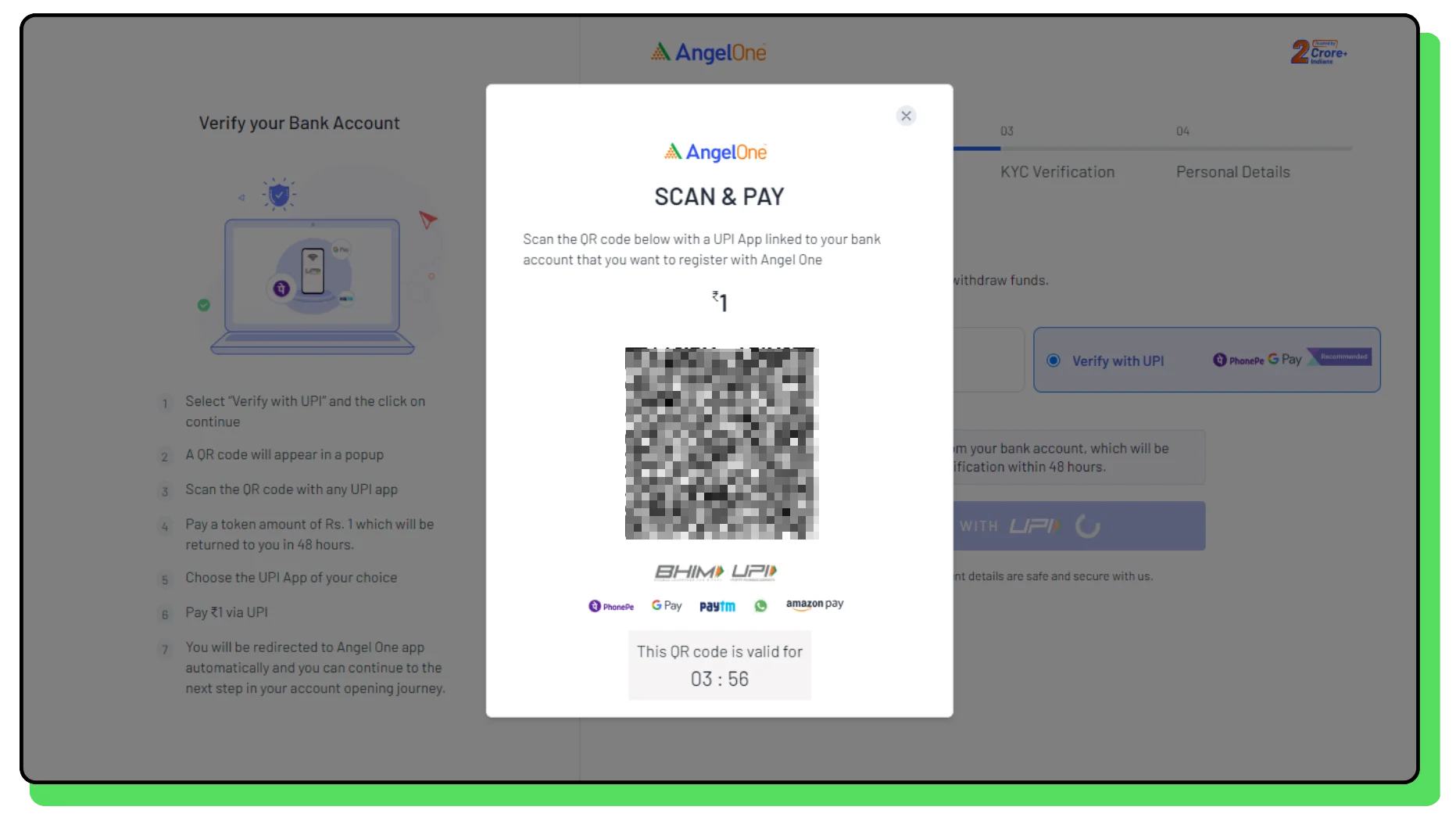

Step 12: Complete Bank Account Verification

After selecting “Verify with UPI,” a QR code will appear on the screen. You need to scan this QR code using a UPI app linked to the bank account you wish to register with Angel One. Please note that the QR code is valid for 4 minutes, so act quickly to make the ₹1 payment.

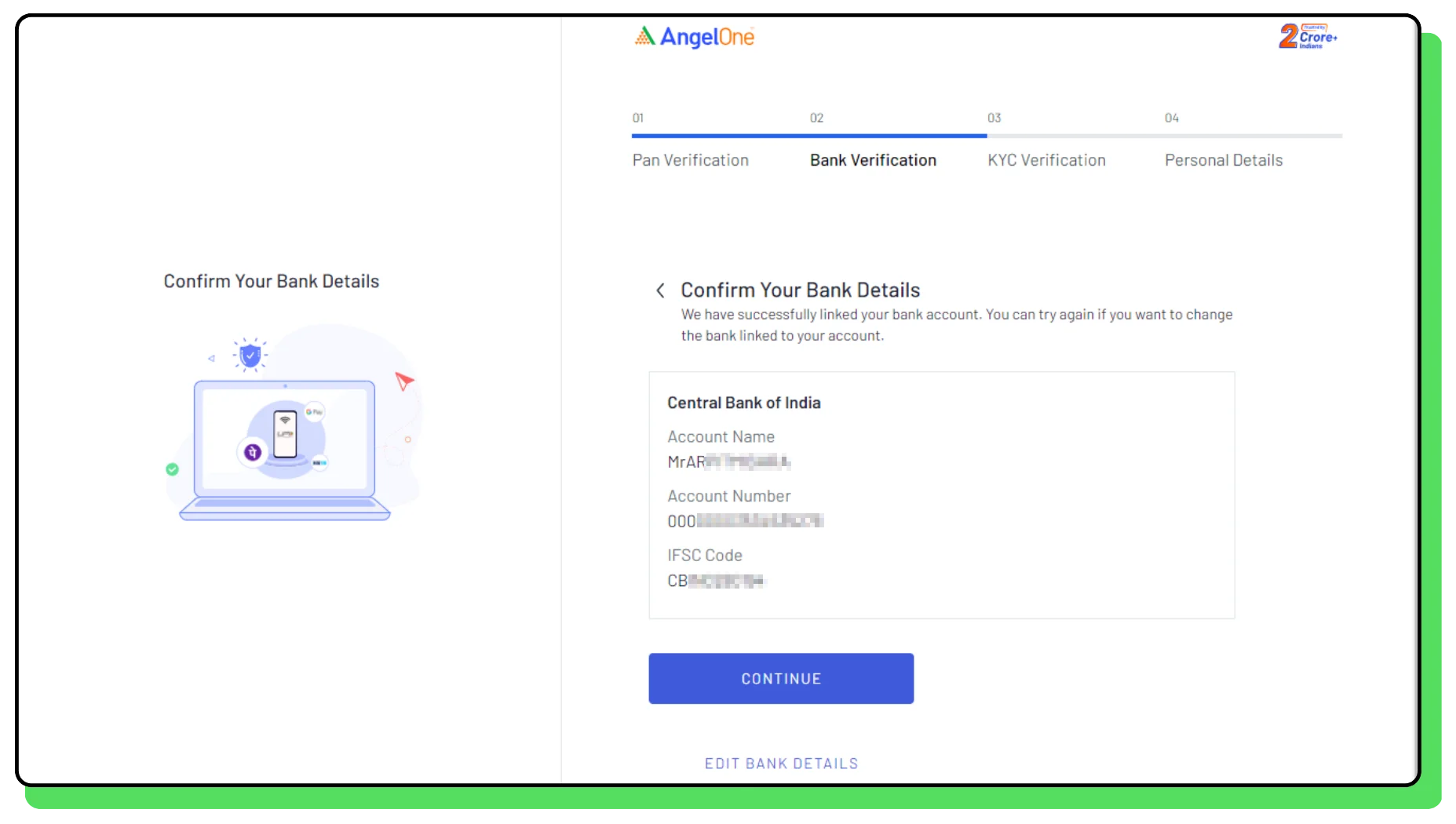

Step 13: Review & Confirm Bank Account Details

Once you make the payment, the bank account details from which the payment was made will be displayed on the screen. Double-check your Account Name, Account Number, and IFSC code for accuracy. If you need to edit any bank account details, click on the “Edit Bank Details” option. If everything looks correct, simply click the “Continue” button to proceed further.

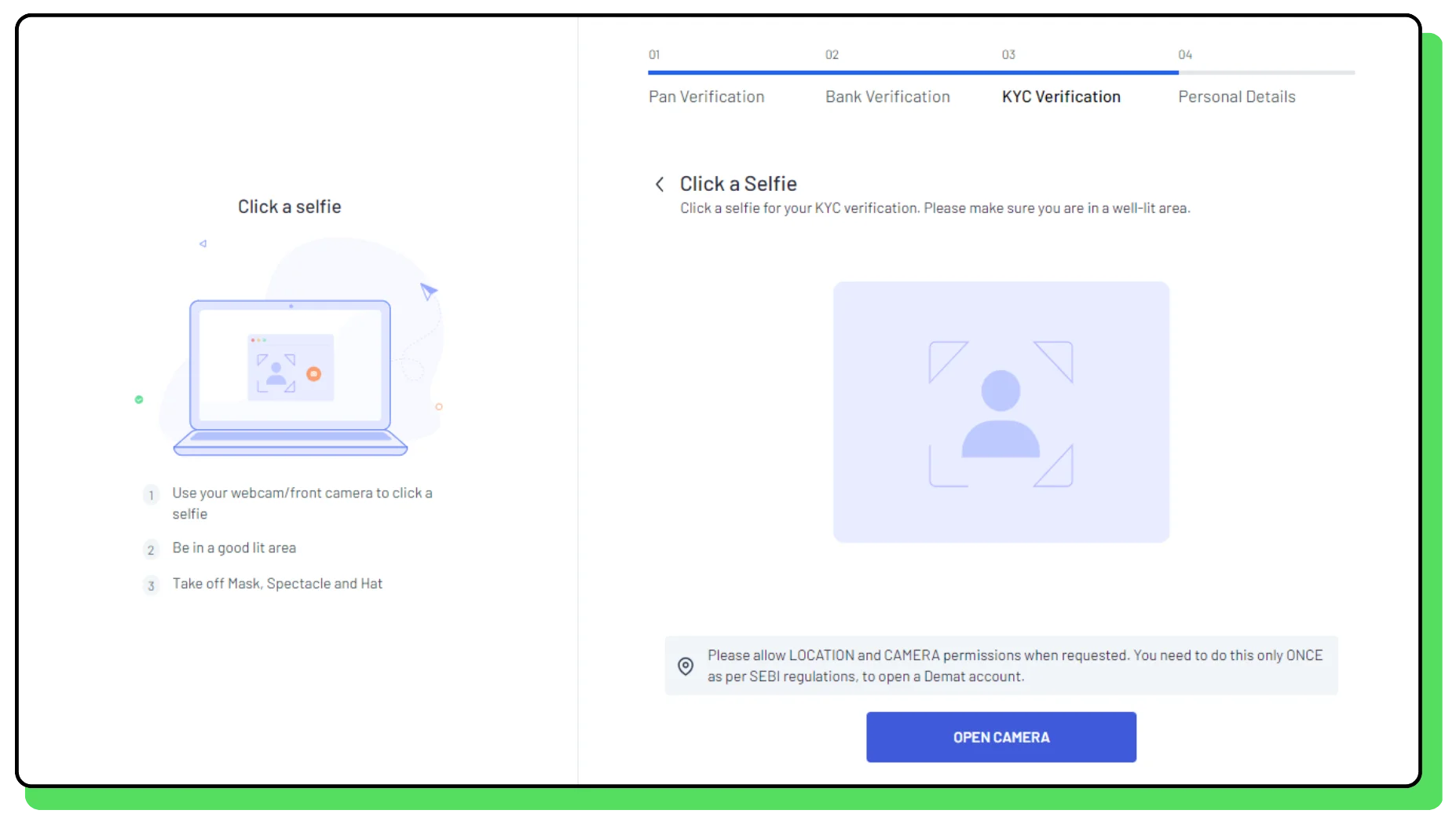

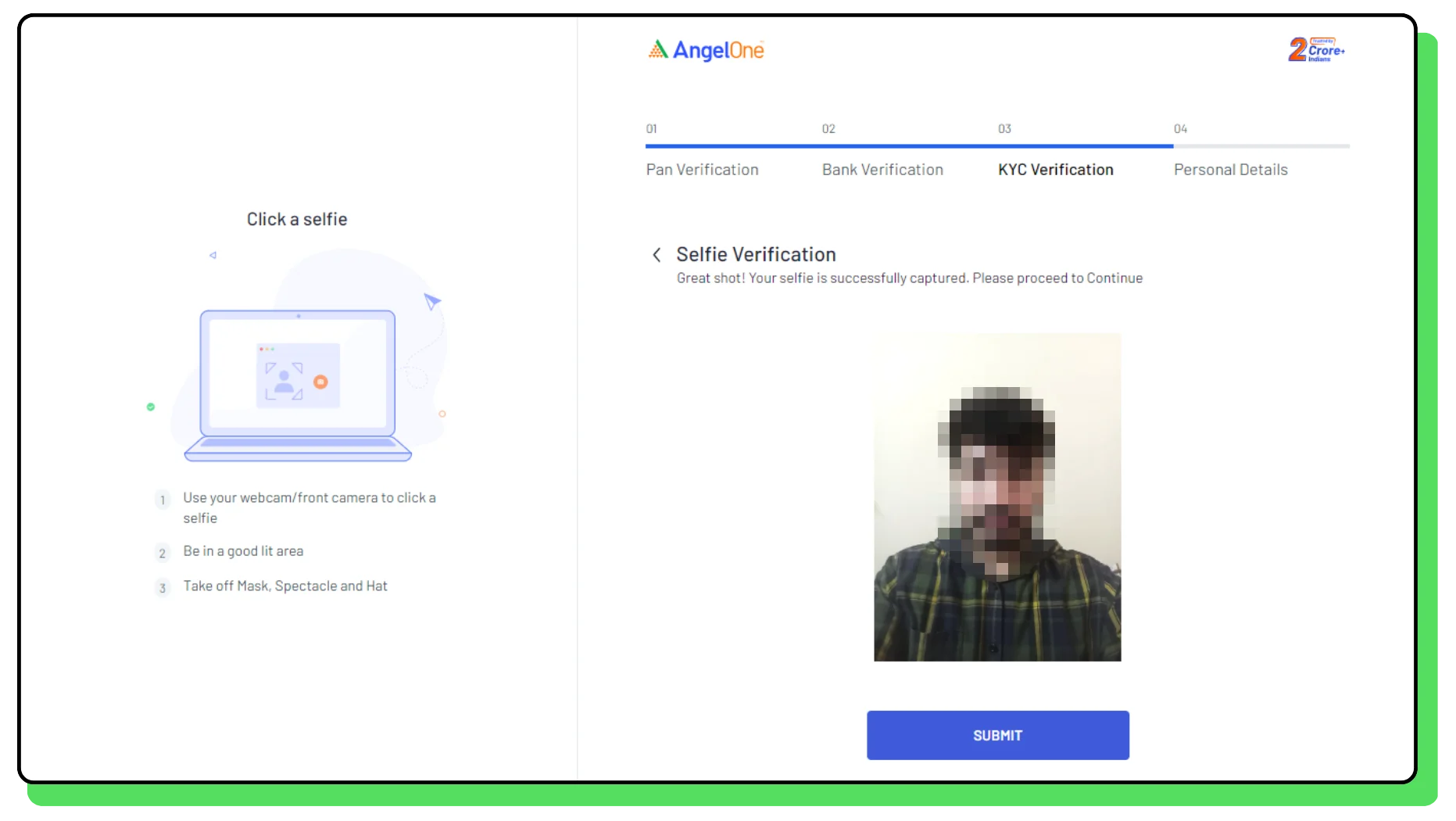

Step 14: Take a Selfie for KYC Verification

In this step, you will need to take a selfie for KYC verification. Make sure you are in a well-lit area with a plain wall behind you. Remove any masks, spectacles, or hats you may be wearing.

You will have two options for taking your selfie:

- Take Selfie from Laptop or Webcam Camera

- Take Selfie on Mobile Browser

Using your mobile is preferable, as selfies taken on mobile devices are generally clearer and get approved faster.

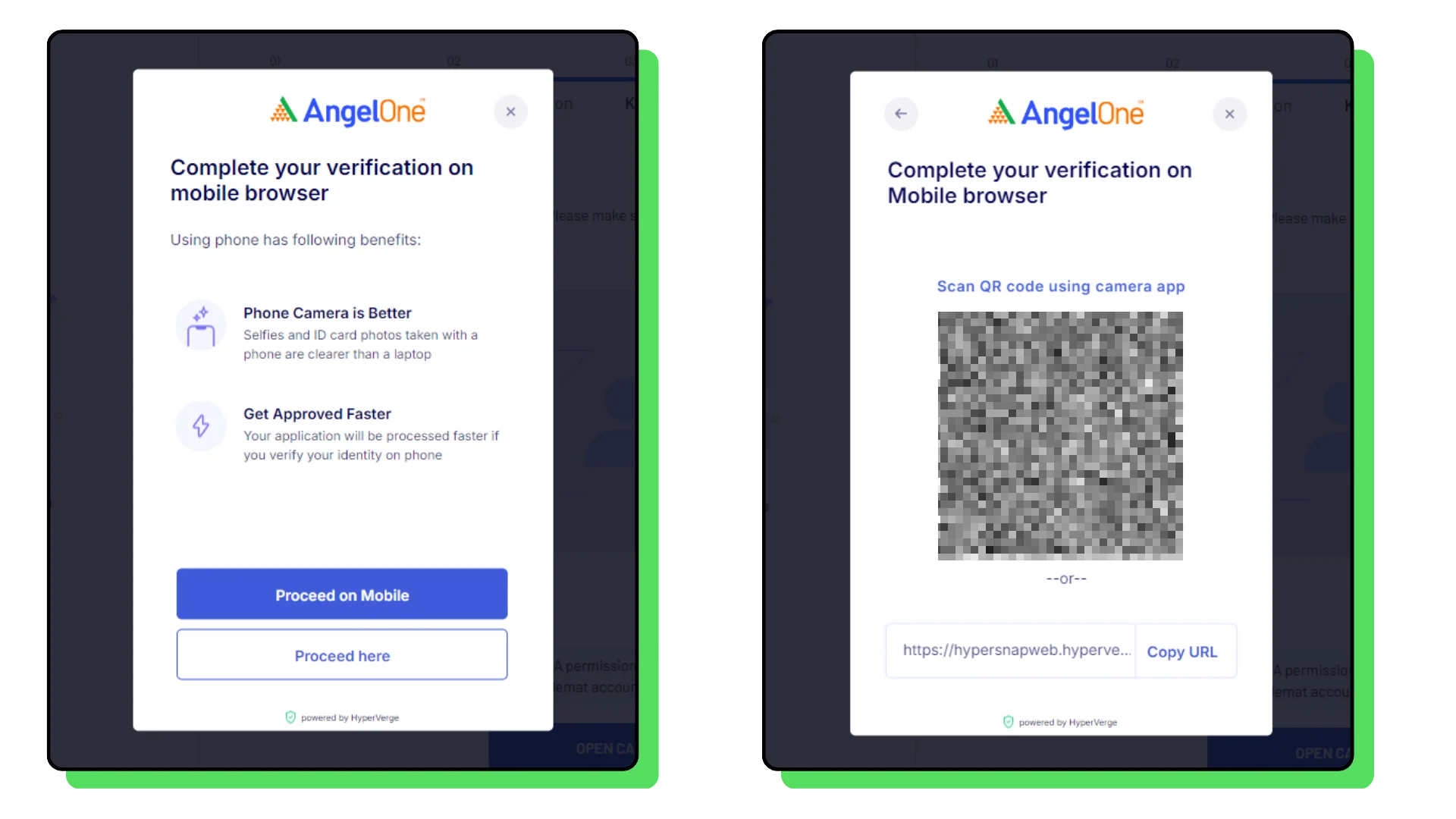

When you click on the “Open Camera” option, a popup will appear asking if you want to take a selfie using the mobile browser. If you choose to proceed with your mobile, click on “Proceed on Mobile.” Otherwise, select “Proceed Here” to use your laptop or PC.

If you select the mobile browser option, a QR code will appear that you can scan with your mobile device, redirecting you to the Angel One selfie page. Capture your image and submit it. After submission, you can close the mobile page and continue the demat account opening process from your laptop or PC where you left off.

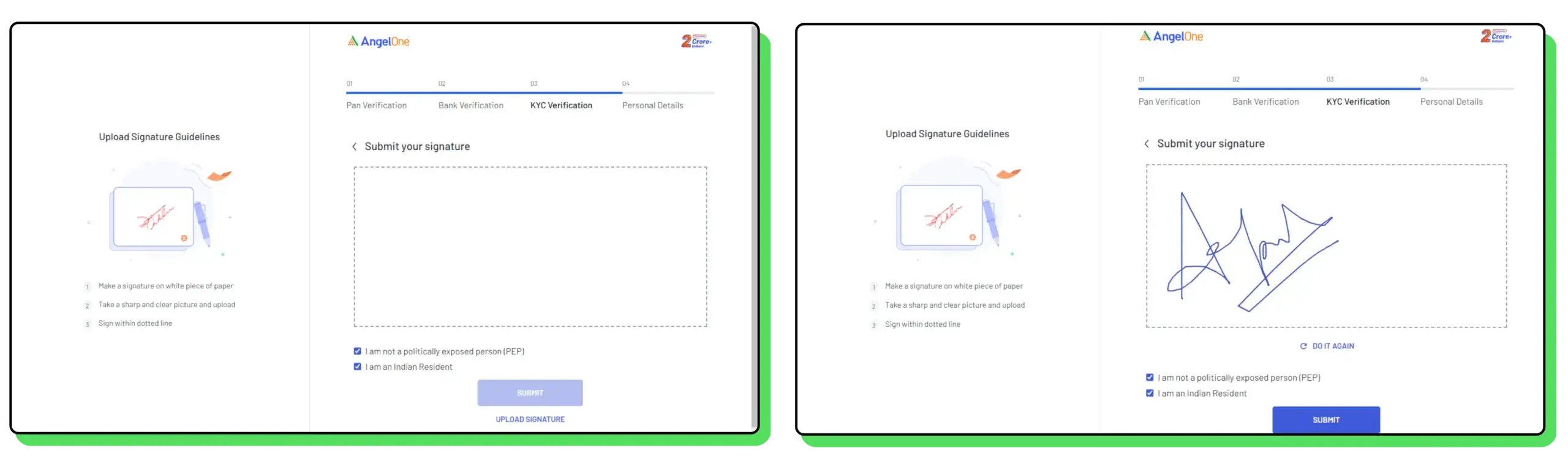

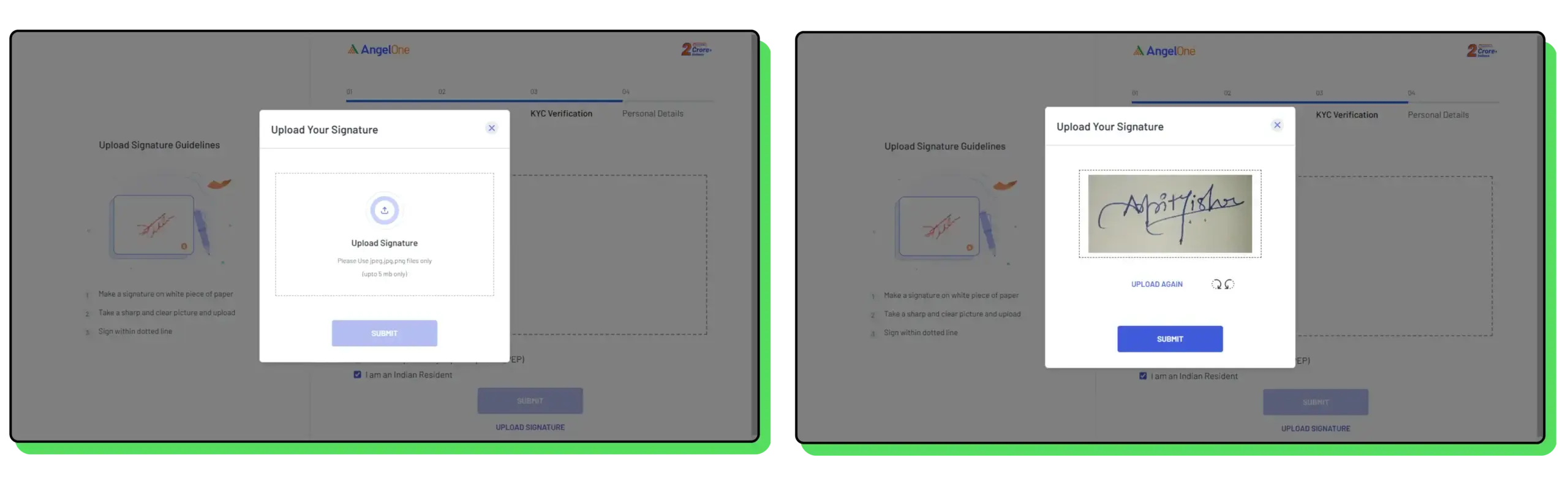

Step 15: Submit Your Signature

After successfully submitting your selfie, you will need to provide your signature. You can sign digitally on the white blank area visible on the screen using your laptop, or you can upload an image of your signature (as shown in the image below). Before uploading your signature, make sure to review the signature guidelines provided on the left side of the screen.

Once you have either signed digitally or uploaded your signature, click the “Submit” button to proceed. This step will complete your KYC verification process.

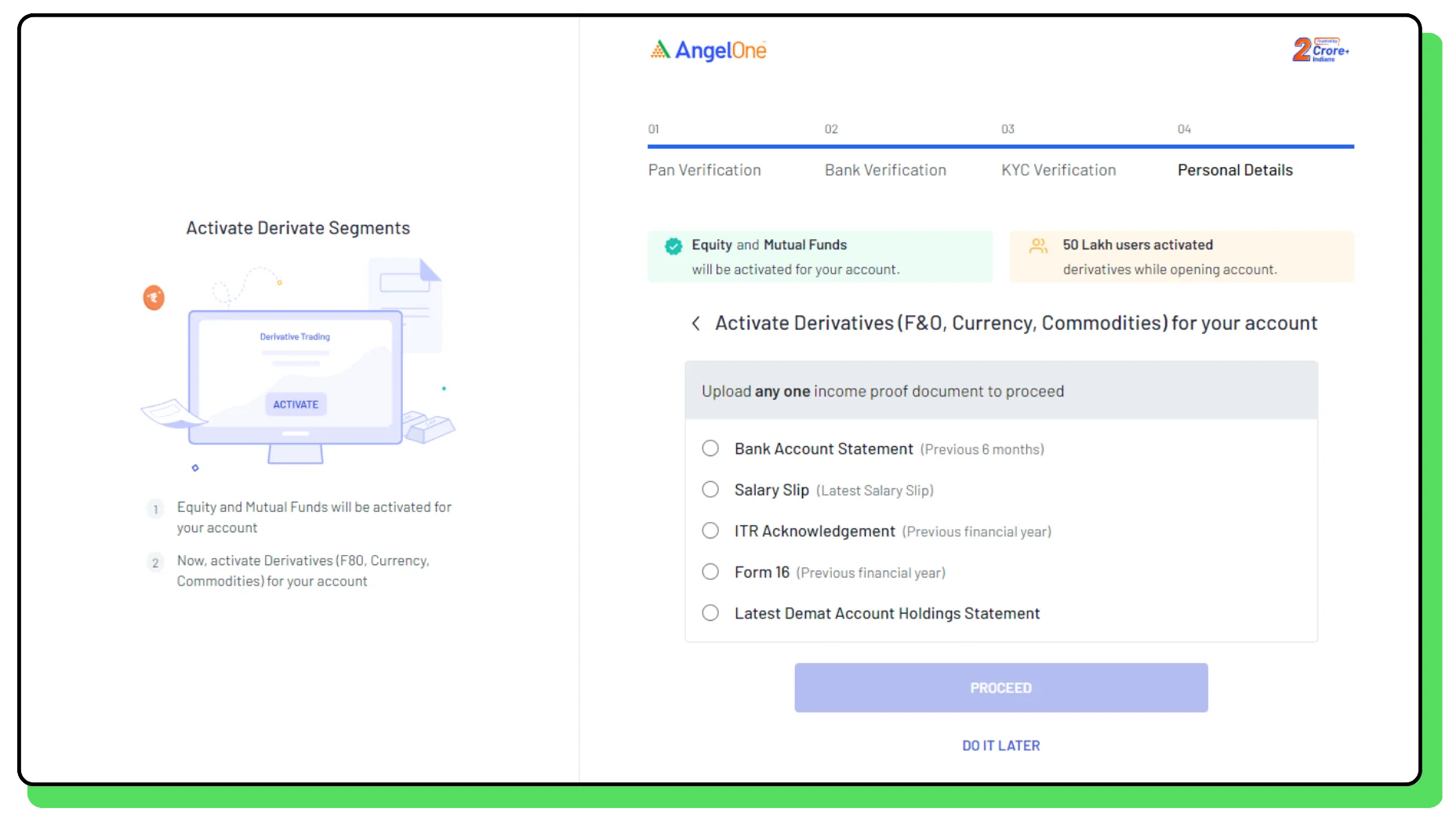

Step 16: Activate Derivatives (Optional)

In this step, you have the option to activate Derivatives (F&O, Currency, Commodities) for your account. If you wish to proceed with activation, you will need to upload one income proof document from the following options:

- Bank Account Statement (Previous 6 Months)

- Salary Slip (Latest one)

- ITR Acknowledgement (Previous Financial Year)

- Form 16 (Previous Financial Year)

- Latest Demat Account Holding Statement

If you prefer to activate derivatives later, you can choose the “Do it Later” option and continue to the next step.

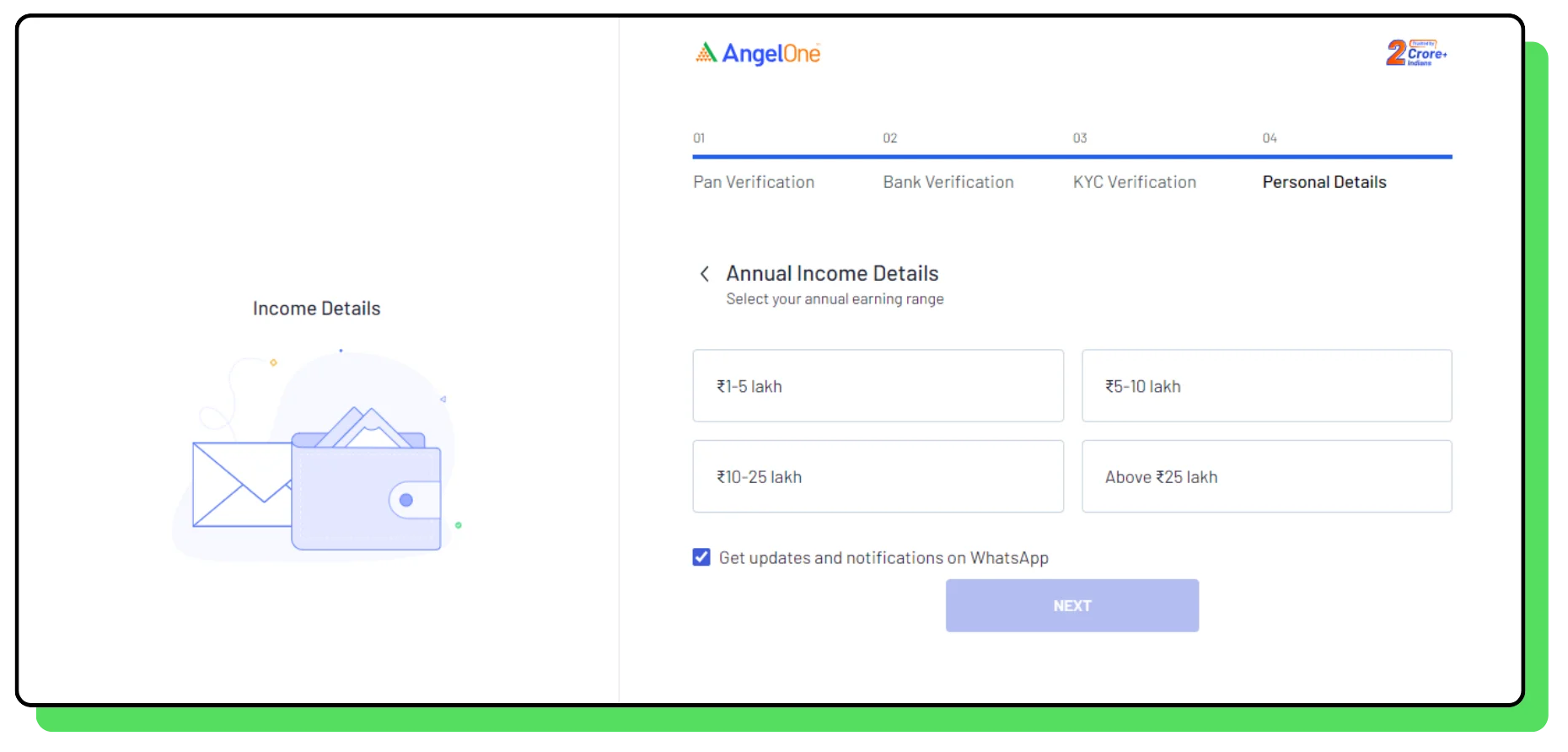

Step 17: Select Your Annual Income Details

In this step, you will need to select your annual income details from the following options:

- ₹1-5 lakhs

- ₹5-10 lakhs

- ₹10-25 lakhs

- Above ₹25 lakhs

If you are a student and do not have an annual income, it is recommended to select the lowest annual income range from the available options.

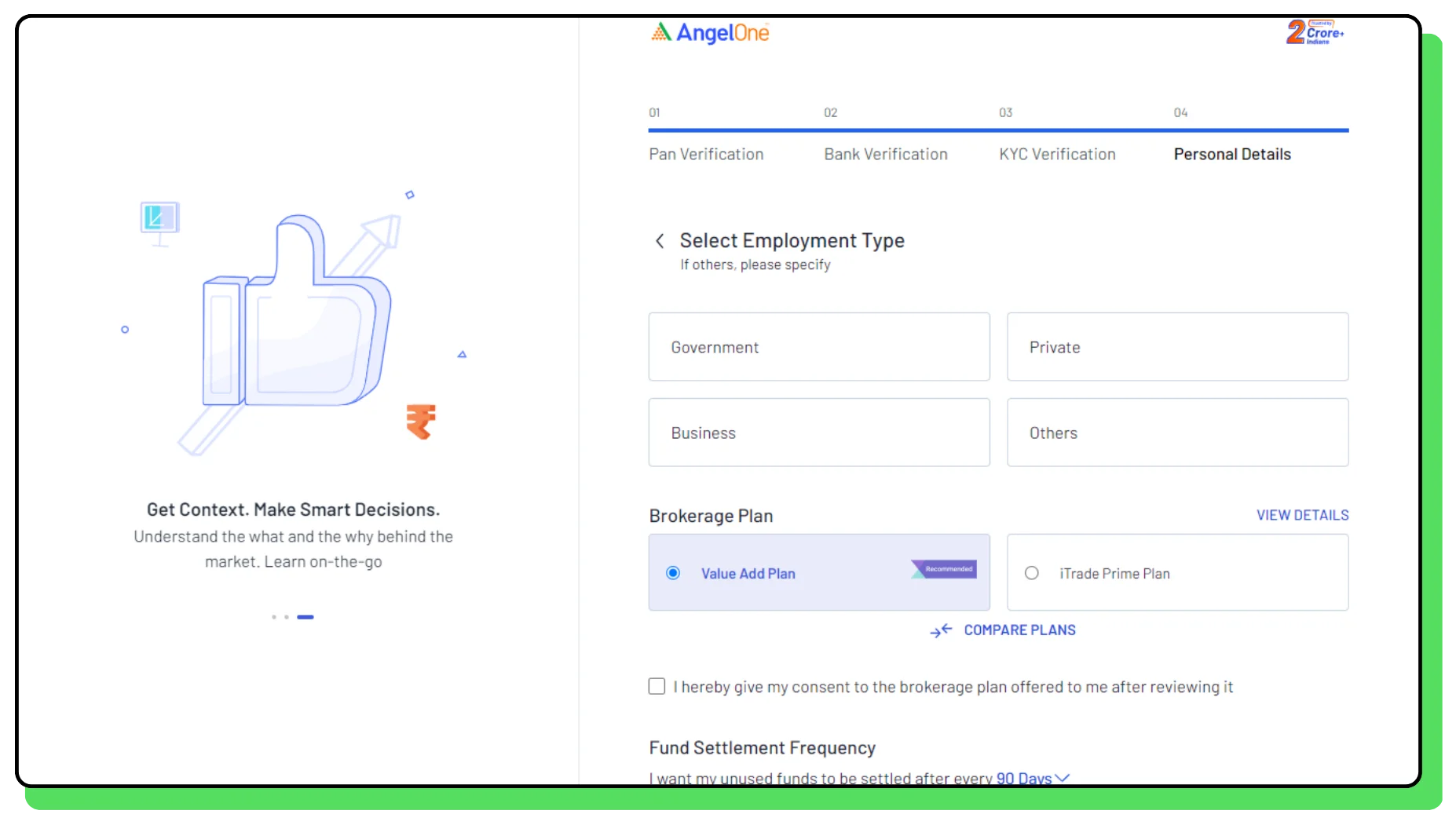

Step 18: Finalize Your Demat Account Opening

This is the last step in your demat account opening process. In this step, you will be asked to select your Employment Type, Brokerage Plan, and Fund Settlement Frequency.

- Employment Type: You will have three options to choose from: Government, Private, or Business. If your employment type does not fall under these categories, select the “Other” option and specify your employment type.

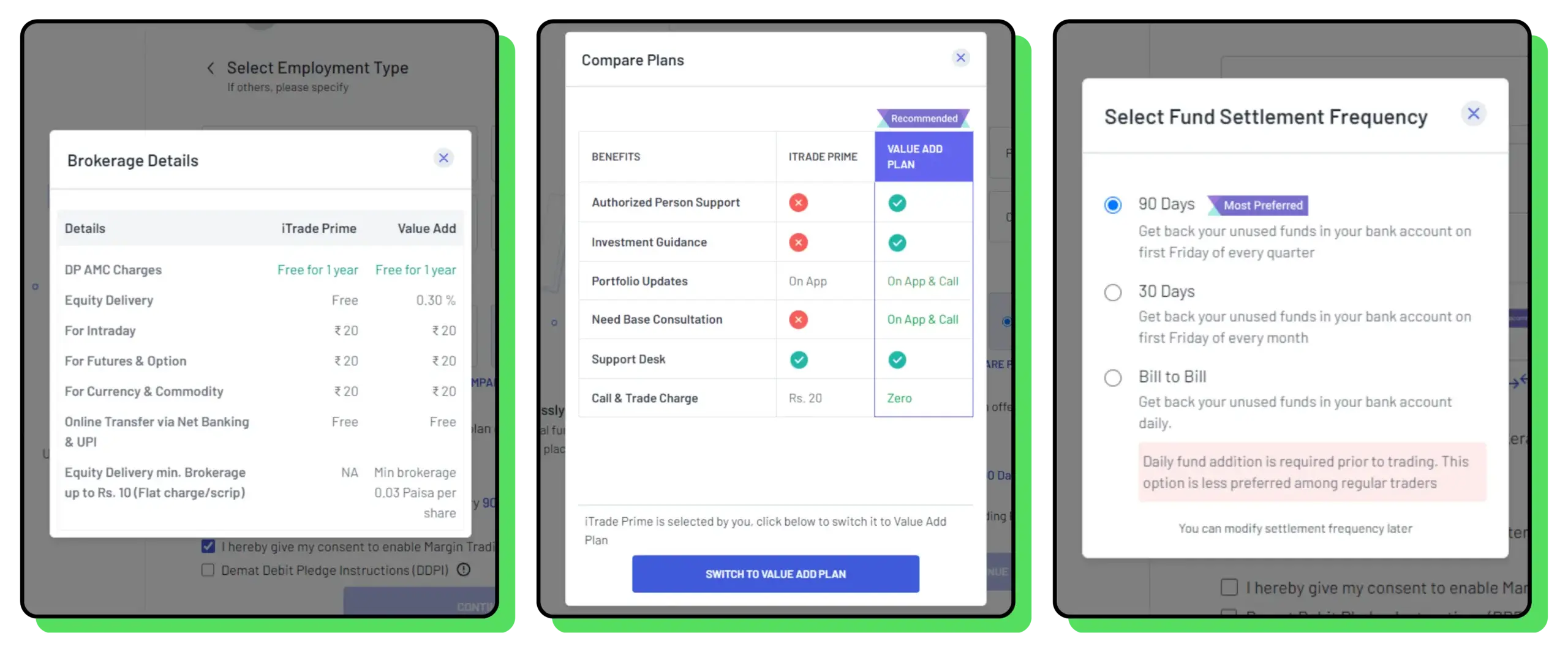

- Brokerage Plan: You will need to select one plan from the two available options: Value Added Plan and iTrade Prime Plan. Please refer to the images below for plan details and comparisons. It is recommended to choose the iTrade Prime Plan.

- Fund Settlement Frequency: This option determines how often your unused funds will be settled in your bank account. It is advisable to select 30 days for this option.

Finally, you will need to give your consent to enable the Margin Trading Facility and Demat Debit Pledge Instructions (DDPI). The DDPI option allows you to avoid entering your TPIN every time you place an order or trade.

Once you have made all your selections, click the “Continue” option to complete your Demat account opening application process.

Step 19: Digitally Sign Your Application Form

In this step, you will be redirected to digitally sign your application form using your Aadhar number. Enter the same Aadhar number linked to your mobile that you provided earlier. After entering your Aadhar number, you will receive an OTP on your linked mobile number. Enter the OTP to proceed.

Once you submit the form, it will go through a reviewing process, which may take a maximum of 3 days. After the review is completed, your demat account will be ready for trading.

Open Free Demat Account with Angel One

Do Share your Thoughts via Comments